Managing your finances is essential, whether you’re an employee, freelancer, small business owner, or self-employed individual. One of the most important documents for tracking your income is a paystub.

A paystub serves as proof of income and includes details like gross pay, deductions, and net pay. Many people use paystubs for tax filing, loan applications, and rental agreements. But what if you don’t receive a paystub from an employer?

The solution is simple: use a free paystub generator. In this blog, we’ll explain:

✔️ What a paystub is and why you need it

✔️ How to use a free paystub generator

✔️ Steps to create a professional paystub in minutes

✔️ Tips to ensure accuracy and legality

Let’s get started!

What is a Paystub?

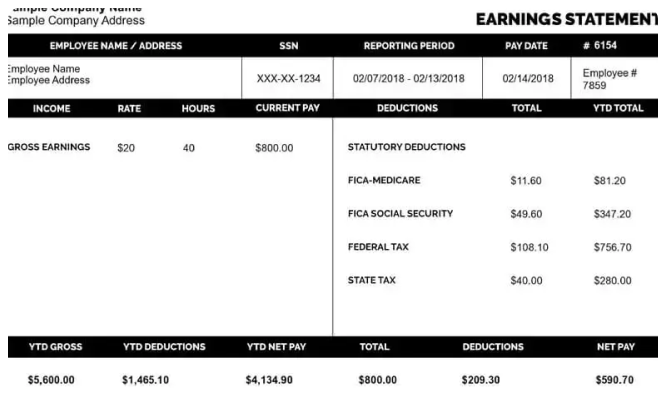

A paystub (also called a paycheck stub or earnings statement) is a document that details an employee’s earnings and deductions. Employers usually issue paystubs with each paycheck, but self-employed individuals and freelancers often need to create their own.

A paystub typically includes:

✔️ Employee information – Name, address, and Social Security number (optional).

✔️ Employer details – Company name and address.

✔️ Pay period & date – The period for which wages are paid.

✔️ Gross pay – Total earnings before deductions.

✔️ Deductions – Taxes, Social Security, Medicare, and other withholdings.

✔️ Net pay – The final amount the employee takes home.

Why Do You Need a Paystub?

Paystubs are necessary for various reasons, including:

1. Proof of Income

Many institutions require proof of income for:

✔️ Loan applications – Banks and lenders need paystubs to verify your earnings.

✔️ Rental agreements – Landlords check income stability before approving tenants.

✔️ Credit card applications – Some credit issuers request income proof.

2. Tax Filing & Compliance

✔️ Paystubs help track income and tax withholdings.

✔️ The IRS may request income proof during audits.

✔️ Self-employed individuals can use paystubs to organize their earnings.

3. Employment Verification

✔️ Future employers may ask for previous paystubs to confirm salary history.

✔️ Some government benefits require income verification.

4. Financial Planning

✔️ Helps employees track earnings, deductions, and savings.

✔️ Assists freelancers and small business owners in budgeting and financial planning.

If you don’t receive a paystub from an employer, a free paystub generator is the best way to create one.

How to Create a Paystub Online for Free in Minutes

A paystub generator free tool simplifies the process by allowing users to enter income details and generate a professional paystub instantly. Here’s a step-by-step guide:

Step 1: Choose a Free Paystub Generator

To create a paystub, select a trusted and secure online paystub generator.

🔹 Popular Free Paystub Generators:

✔️ 123PayStubs – Quick and easy to use.

✔️ Paystub.org – Generates paystubs with automatic tax calculations.

✔️ CheckStubMaker – Professional templates for freelancers and small businesses.

✔️ PayStubs.net – Offers customizable paystub formats.

🔹 What to Look For:

✔️ Free access with no hidden fees.

✔️ SSL encryption for data security.

✔️ Automatic tax and deduction calculations.

Step 2: Enter Employer & Employee Information

Fill in basic details to personalize your paystub.

✔️ Employer Name & Address – The business or company name issuing the paystub.

✔️ Employee Name & Address – The person receiving the paystub.

✔️ Pay Period & Pay Date – Weekly, bi-weekly, or monthly payment cycle.

🔹 Example:

- Employer: ABC Consulting, New York, NY

- Employee: John Doe, Los Angeles, CA

- Pay Period: March 1 – March 15, 2025

- Pay Date: March 16, 2025

Step 3: Add Salary or Hourly Wage Information

Enter income details based on your pay structure:

✔️ Hourly Employees:

- Enter hourly wage and total hours worked.

- Example: $20 per hour × 80 hours = $1,600 gross pay.

✔️ Salaried Employees:

- Enter monthly or annual salary.

- Example: $50,000 per year ÷ 12 months = $4,166.67 gross pay.

Step 4: Include Deductions & Taxes

A paystub generator free tool will automatically calculate standard deductions. These may include:

✔️ Federal Tax – Based on IRS tax brackets.

✔️ State Tax – Varies by location.

✔️ Social Security (6.2%) – Required deduction.

✔️ Medicare (1.45%) – Required deduction.

✔️ Other Deductions – Health insurance, retirement contributions, etc.

🔹 Example Calculation:

- Gross Pay: $1,600

- Federal Tax: $160

- State Tax: $80

- Social Security (6.2%): $99.20

- Medicare (1.45%): $23.20

- Net Pay (Take-Home Pay): $1,237.60

Step 5: Review and Download the Paystub

✔️ Check all details for accuracy.

✔️ Preview the paystub and make any corrections.

✔️ Download the paystub as a PDF or print it immediately.

🔹 Tip: Save digital copies for your financial records and tax filing.

Tips for Creating a Legal & Accurate Paystub

✔️ Use only accurate information – False paystubs are illegal.

✔️ Ensure tax calculations are correct – IRS compliance is crucial.

✔️ Keep copies of paystubs for records – Helps with future verification.

✔️ Verify net pay matches bank deposits – Ensures consistency.

Final Thoughts

A free paystub generator is a quick, easy, and legal way to create paystubs online in minutes. Whether you’re an employee, freelancer, or small business owner, using a paystub generator free tool ensures you have accurate proof of income for loans, taxes, and financial planning.

Key Takeaways:

✔️ Paystubs provide proof of income, tax records, and employment verification.

✔️ A paystub generator free tool creates paystubs instantly and accurately.

✔️ Choose a trusted paystub generator with automatic tax calculations.

✔️ Always double-check details to ensure legality and accuracy.