50/30/20 Budget Rule: How to Make It Work for You

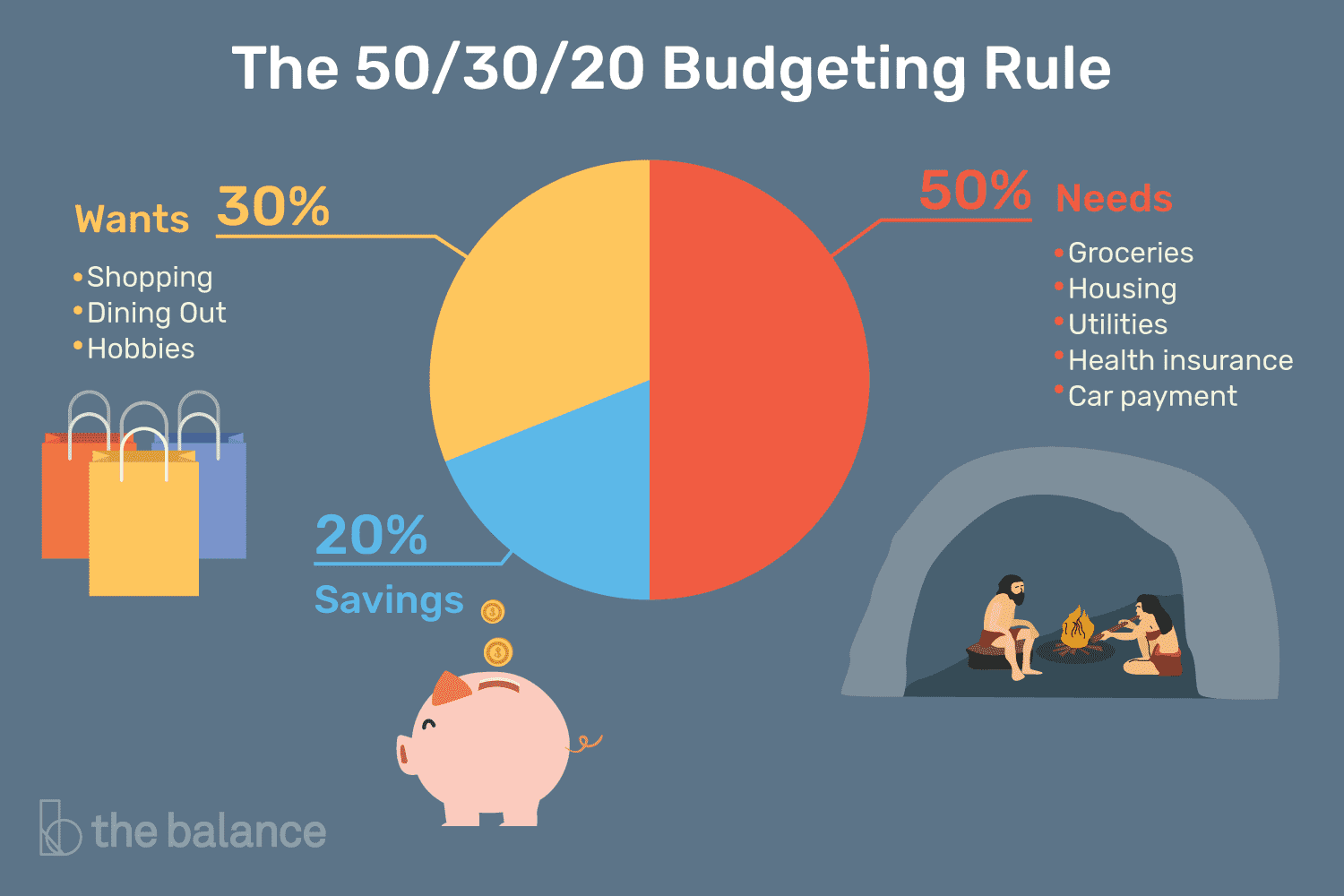

Budgeting can be hard, but it doesn’t have to be. The 50/30/20 rule is a simple way to manage your money. It breaks your income into three categories: needs, wants, and savings. This method can help you take control of your finances and plan for a secure future.

What is the 50/30/20 Rule?

The 50/30/20 budget rule is a guideline that divides your monthly income into three parts:

- 50% for Needs

- 30% for Wants

- 20% for Savings

This system is easy to follow and helps you make sure you are spending wisely. Let’s break down each category.

50% for Needs

Your “needs” are the things you must have to live and work. This includes things like:

- Rent or mortgage

- Utilities (water, electricity, internet)

- Groceries

- Insurance (health, car, etc.)

- Transportation (gas, public transport)

These are the essential expenses. Without them, it would be hard to survive or function in society. When creating your budget, list all the things you need each month. Make sure they total no more than 50% of your income.

Tip: If your needs exceed 50%, look for areas to cut back. Maybe you could downgrade your living situation or find cheaper transportation options.

30% for Wants

“Wants” are things you enjoy but don’t need. They make life more fun but are not essential for survival. Examples of wants include:

- Eating out at restaurants

- Movies or concerts

- Shopping for clothes (beyond basic necessities)

- Streaming services (Netflix, Spotify, etc.)

- Vacations or travel

Wants are nice to have, but they can eat into your budget if you’re not careful. The 50/30/20 rule suggests spending no more than 30% of your income on wants. This ensures you can still enjoy life while managing your finances.

Tip: Track your spending on wants. Are there any areas you could cut back? For example, cooking at home instead of dining out can help you save money.

20% for Savings

The final part of the 50/30/20 rule is saving. This includes saving for:

- Emergency fund

- Retirement (e.g., 401(k) or IRA)

- Debt repayment

- Short-term goals (like buying a car or house)

Saving at least 20% of your income helps you build financial security. This gives you peace of mind knowing that you are prepared for unexpected expenses or long-term goals.

Tip: If 20% feels like too much, start small. You can save 10% and gradually increase it as your financial situation improves.

How to Implement the 50/30/20 Rule

- Calculate Your Income: Start by knowing how much you earn each month. This includes your salary, bonuses, or any side income.

- Track Your Expenses: Make a list of all your expenses. Separate them into needs, wants, and savings. This can be done with a simple spreadsheet or an app.

- Adjust Your Spending: Once you know where your money goes, see if you are following the 50/30/20 rule. If your needs are over 50%, see where you can cut back. If your wants are too high, try to reduce unnecessary spending.

- Pay Yourself First: Before spending on wants or needs, pay yourself. Put your 20% savings into a separate account. This ensures you are building your future before spending on non-essentials.

- Review Regularly: Your budget isn’t set in stone. Life changes, and so will your income and expenses. Regularly review your budget to make sure it’s still working for you.

Benefits of the 50/30/20 Rule

- Simplicity: This rule is easy to follow and doesn’t require complex calculations. It gives you a clear picture of your finances.

- Balance: The 50/30/20 rule ensures that you are spending money on the things that matter, without overindulging in wants. It helps you live a balanced life.

- Financial Security: By saving 20% of your income, you are preparing for the future. You’ll be better equipped to handle emergencies or unexpected costs.

- No Guilt: The rule allows you to spend money on fun things (wants) without guilt. As long as you stick to the 30%, you are doing great.

Adjusting the Rule for Your Situation

The 50/30/20 rule is a guideline, not a strict rule. You can adjust it based on your situation. For example, if you live in an expensive city, your “needs” category may need to be higher than 50%. On the other hand, if you don’t have many wants, you might spend less in that category and save more.

If you are trying to pay off debt, you might allocate more money to savings or debt repayment. Similarly, if you’re working toward a big financial goal, like buying a house, you could adjust the percentages temporarily to save more.

Challenges of the 50/30/20 Rule

While the 50/30/20 rule is helpful, it might not always work for everyone. If you live paycheck to paycheck or have high debt, following the rule exactly might be hard. In this case, focus on paying off high-interest debt or building an emergency fund first.

Also, people with irregular incomes (freelancers, for example) may need to adjust the percentages month-to-month, depending on how much they earn.

Tip: If you have irregular income, aim to save more in good months to cover leaner ones.

Final Thoughts

The 50/30/20 rule is a simple, effective way to manage your money. It encourages balance between spending on essentials, enjoying life, and saving for the future. Whether you’re new to budgeting or looking for a way to improve your financial habits, the 50/30/20 rule is a great starting point.

By following this method, you can live within your means while still enjoying the things that make life fun. Over time, the savings will add up, and you’ll feel more in control of your financial future.

Remember, the key is to keep it simple, stay disciplined, and make adjustments as needed. Your financial goals are within reach!Ready to take control of your finances? Start applying the 50/30/20 Budget Rule today and visit Venzec.icu for more expert insights on financial wellness, self-care, and mindful living.